Don’t throw your portfolio baby out with the bathwater

Before I depart for my first visit back home to Sydney in 4 years, I wanted to get one more article out before I’m on vacation for two…

Before I depart for my first visit back home to Sydney in 4 years, I wanted to get one more article out before I’m on vacation for two weeks. I’m sure I will be thinking of many new blog ideas, I’m going to try and impose some discipline and focus on relaxation instead. So no new blogs until I get back — challenge accepted!

One of the topics I continue to wrestle with (when moving form projects to products) is, ‘how does everything tie together’.

Everything being the linking of actual work through to the top level strategy and goals of an organization. How do you keep and continue to enhance linkage between work, insight, outcomes and value!

In the beginning, there was investment governance

More traditional organizations have been using a series of investment portfolios created around largely two dimensions:

Organizations

department investment budgets (e.g. HR, Marketing, Technology)

products and services (e.g. Corporate, End Users)

regions and legal entities (e.g. Asia Pacific)

Themes

Risk remediation (e.g. audit findings)

Regulatory compliance (e.g. GDPR)

Innovation and technology spend (e.g. cloud, latest tech trends like blockchain, meta-verse, data mesh, machine learning (AI) etc.)

Now, we manage our portfolio of outcomes

The investment items in the portfolio are then used in the board room to understand the investment mix for a given organization within the year to see if they are investing the right amount in each area.

This allows organizations to calibrate investment areas for the year and allow the top brass to steer the ship. We should be investing more in a theme e.g. ‘machine learning’, so lets skim 5% off everyone’s budgets and then fund work around ‘machine learning’ instead.

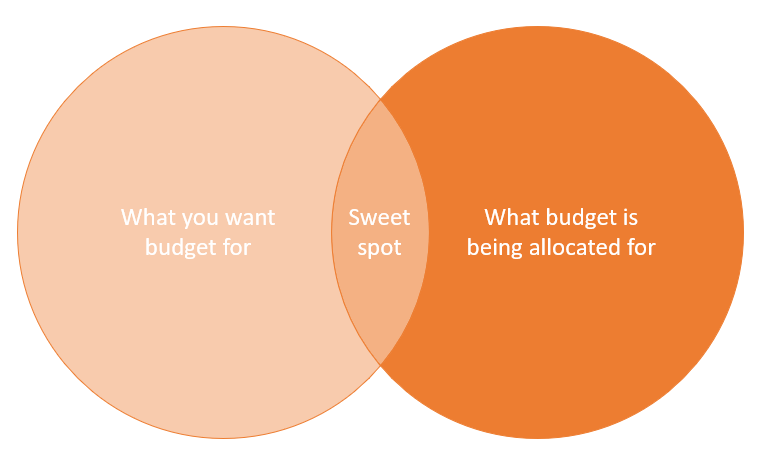

In some cases that theme can be helpful for some departments and for others meaningless. In many cases there is a Venn diagram of work we want to do, work that gets funded and how the work we want to do is like the work that will get funded. If the department wasn’t planning to work on anything related to machine learning — this is often where things get creative.

Quite often the people making the prioritization and budgeting decisions are quite far removed from the underlying detail and because of the timing pressures and cycles ‘good enough, is often good enough’. Departments managed to get their budgets, although how closely what is delivered ties back to the budget themes is debatable.

I will refrain from talking about old-school business case approach as that deserves an article all on its own.

This process often requires many layers of an organization to go back again with several rounds responding to the challenge to see if they even had already thought about something they could deliver around that theme as a way of getting extra investment Dollars for the upcoming year.

This behavior can lead to gamification and simply smearing people costs over many topics as a way of ensuring departments continue to receive the same as the previous year.

People don’t typically want too much extra budget as they can’t spend it without hiring an army, quite often made up of consultants or contractors as the department cannot hire enough people fast enough to spend the money within the time frame.

There’s got to be a better way

When moving to a product-centric approach, you move from funding projects and instead fund teams. This reduces the time and effort spent each year on budgeting for the year and in many cases seen as a positive. It can create a gap in information and insight if not carefully considered.

This is an opportunity to reduce gamification around having too much money or too little. It helps improve the focus around what you are prioritizing rather than how much things cost. This additional time given back should be used to collaborate and ensure that priority is aligned to outcomes (think OKRs), dependencies and more effectively managing risks proactively.

Having the ability to tag high level portfolio items with themes and link to OKRs is a powerful way to achieve similar transparency, crucially it provides greater linkage and accountability to see if the work is contributing to the anticipated outcomes expected.

This can be done on longer time spans without too much effort to ensure that an overall portfolio of work continues to have a mix of investment themes — this is how you demonstrate competence with the Finance department.

When changing to new ways of working, you cannot tell your CFO that you do not plan further than 3 months into the future. People need time to adapt and learn, ensuring transparency is preserved is key to building trust.

This requires more rigor in the shorter time spans and more flexibility on the longer time spans. Don’t ignore the longer time horizons if you have external commitments or risk putting your organization in jeopardy (think regulatory commitments).

Planning also needs to ensure that individual teams / products / value streams are not using 100% of their capacity — otherwise if you have dependencies on them, they won't be able to help you in the coming 3–6 months. This means unintuitively that everyone needs to plan and prioritize with considerable slack in the system so they can respond to higher priority items for the good of the organization and not just the team / product.

This is where OKRs and similar tools can be helpful but are not a silver bullet. Unless you are limiting OKRs in a period and de-prioritizing some over others, you will end up with 3–5 OKRs for every department that get split into more granular OKRs that end up cascading down. All of this before people consider dependencies. I caution teams with having too much focus on their own independent OKRs for this reason or they risk everyone acting independently.

The autonomy and alignment picture from Henrik Kniberg comes to mind.

Full autonomy without alignment is effectively chaos.

Full alignment without autonomy is dictatorship.

What happened to portfolio insight

When moving to capacity based funding, people tend to forget that the insight gained from the portfolio level information is critically important to the most senior part of the organization as it allows them to understand in aggregate if the organization is investing in the ‘right things’.

As part of moving to funding teams, you should not forget about how you visualize, plan, and collaborate on investment areas that others want visibility on e.g. Your Finance department may need to capitalize some of the budget.

Visualizing portfolio level items is key here, consider looking into how you structure your portfolios so that they are separate to your individual product / team backlogs. Limiting your WIP is also incredibly useful if you want people to focus and find the value in ‘getting things done’. It takes time for senior leadership to understand the value in not flooding the system of work.

“adding manpower to a late software project makes it later”

Brooks’s law

When moving to shorter planning time horizons, people assume that means taking an extreme view and omitting any plans greater than now and next (e.g. 3–6 months).

Moving from yearly to quarterly planning does not mean that you stop over longer time horizons, it just means that your granularity and certainty of the plans are a lot lower and positively something that can be changed as the organization leans and adapts. I prefer to think of these plans as roadmaps and crucially they aren’t commitment based but a best guess at any point in time that is subject to change as we learn more and get closer to the date.

Once your organization learns that it can move and redirect focus and priority in shorter increments you can start to see an organization becoming more agile, as opposed to a team.

How robust are those assumptions?

However what the board room often don’t understand and don’t want to understand in most cases are the assumptions built into those estimates and plans that people have produced the big areas being:

do you have the people available in your department to deliver

do those people have the necessary skills to successfully deliver

have you factored dependencies into your plan

are those dependant organizations ensuring their portfolios and capacities are aligned with your plans to ensure they are collaborating with you when you need them too

Depending on your organization, industry, and other factors you may have scrutiny from external parties as well (e.g. regulators) who are keen to understand your investment appetites on certain investment themes / topics.

This often serves as a proxy for ‘how seriously are you taking a given topic’. I tend to think of this as a Goldilocks zone type expectation, spend too little and your organization isn’t taking regulation seriously, spending too much and you are over bloated and not running efficiently.

Next time!

In subsequent articles, I’d like to start to describe some options around how you can start to establish your own portfolios in large complex organizations (I’m not yet sure if they scale down to smaller companies). I will be leaning heavily on: Better Value Sooner, Safer, Happier & Flight Levels for some my inspiration.